can you go to jail for not paying taxes uk

There are five years in jail and a fine of as much as 100000 for income. The maximum failure-to-file penalty is 25.

Emma Thompson Mulls Withholding Taxes Following Hsbc Scandal Short Hair Styles Short Hairstyles Over 50 Hair Styles

If you owe more than you can afford the IRS will work out a payment plan or possibly even an Offer in Compromise.

. Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen. May 4 2022 Tax Compliance. If your return is more than 60 days late the minimum penalty for not filing taxes is 435 or the amount of tax owed whichever is smaller.

It is possible to go to jail for not paying taxes. The actors federal tax debt was estimated to be around 12 million. To avoid having to pay exorbitant penalties and interest rates on top of your owed taxes it is best.

This penalty will stay in place until the entire amount of tax debt has been paid. Can you go to jail for not paying tax UK. If however you are charged.

Unpaid taxes arent great from the IRSs perspective. Business rates see Business Debtlines Factsheet. But you cant be sent to jail if you dont have enough money to pay.

Sections 19705 and 19706 of the California Revenue and Taxation Code apply. Taxes evasion summary conviction may result in six months in jail or a fine of 1000. The general answer for how long you will spend in county jail for tax evasion in California is one year.

There will be fines involved in tax evasion and in the UK the maximum punishment is typically jail time. If you are found guilty the penalties can include substantial fines and a prison sentence. Snipes allegedly hid income in offshore accounts and did not file federal income tax returns for several years.

You can go to jail if you lied on your tax return or didnt file one. These penalties amount to 5 of a taxpayers delinquent debt each month it remains unsettled. However failing to pay your taxes doesnt automatically warrant a jail sentence.

Whether a person would actually go to jail for not paying their taxes depends upon all the details of their individual tax circumstances. A tax debt of 10000 will then incur a monthly interest of 500. Tax evasion can result in heavy fines and the maximum penalty for tax evasion in the UK can even result in jail time.

However you cant go to jail for not having enough money to pay your taxes. The short answer to the question of whether you can go to jail for not paying taxes is yes. However you can face jail time if you commit tax evasion tax fraud or do.

But only if you did so on purpose. Book a call today. Income tax and VAT debts this is very rare as its used mainly for large scale tax evasion rather than just.

You can go to jail for lying on your tax return. If an employee makes 4000 a month and the employer is supposed to pay 1000 tax and doesnt thats not the employers money thats the employees money. Income tax evasion penalties summary conviction is 6 months in jail or a fine up to 5000.

In the UK offenders are generally charged with seven or unlimited penalties for tax evasion. After all your failure to pay taxes might simply just be because of harmless neglect that can be overlooked and. To better understand these distinctions take a closer look at when you risk jail time for failing to pay your taxes.

But the government cant prosecute you for not having enough money to pay taxes. Al Capone being the most famous example. Not being able to pay your tax bill.

However the state has two codes that deal with tax evasion. A person including a corporation who is unable to pay their debts which includes taxes. A special case is not paying the income tax that the company is supposed to be paying on behalf of its employees.

Each code has its punishments which may or may not include prison time. Try the UKs fastest and most trusted digital tax advice service. The United States doesnt just throw people into jail because they cant afford to pay their taxes.

Actor Wesley Snipes also did time for failing to pay his taxes. Council tax arrears see National Debtlines Factsheet. Police will not be kicking down your door and take you away in handcuffs.

First in both the US and the UK there are criminal sanctions including prison terms for breaching tax laws. I n July 2016 Melanie Woolcock a single mother from Bridgend in Wales was given an 81-day jail sentence for failing to pay her council tax. It depends on the situation.

Sometimes people make errors on their tax returns or are negligent in filing. The maximum penalty for income tax evasion in the UK is seven years in prison or an. If you evade income taxes you could go to jail for six months for a summary conviction or be fined up to 5000 for the first offense.

Yes he was sent to prison for tax evasion not for bootlegging prostitution or murder. Not well enough to work and. This is not the same as legitimately following the tax laws and then being unable to pay when required.

Nor can you be held liable if you can prove that it was just an oversight on your part. You can go to jail for lying on your tax return. You can only be sent to prison for non-payment of debts where the case was heard in a Magistrates Court.

Helping business owners for over 15 years. Can you go to jail for not paying taxes. About a hundred people a year are sent to prison for council tax arrears here is a case where a mother was in prison for 40 days before being released.

However you cant go to jail for not having enough money to pay your taxes. Ad Well pair you with a certified accountant who can chat through your questions and options. The short answer is yes you can go to jail for not paying taxes.

This may have you wondering can you go to jail for not paying taxes. The fine for tax fraud in the UK can reach a maximum of 50000 if you have tried to evade taxes and even jail time could result. The short answer is yes.

The short answer is maybe. Essentially this lets you haggle for a lower tax bill. You can go to jail for not filing your taxes.

Free Ppi Claim Letter Template For Credit Card Letter Templates Small Business Cards Lettering

Spain Seeks Eight Year Jail Term For Shakira In Unpaid Taxes Case Shakira The Guardian

Pre Sentencing Report Template Fill Online Printable Pertaining To Presentence Investigation Report Template Professional Template

Picture Memes Qwewtflq6 1 Comment Ifunny

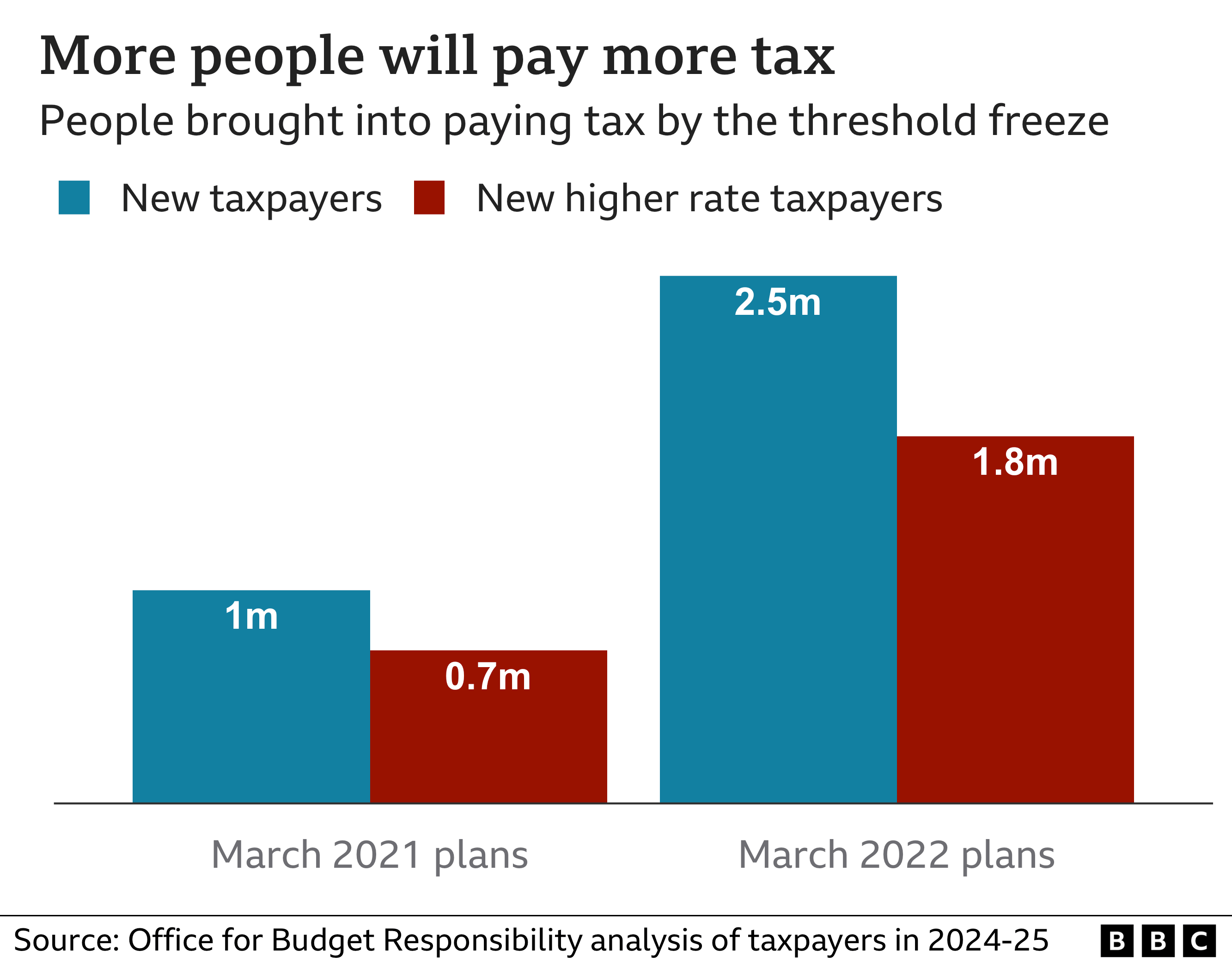

Spring Statement Is This Really The Biggest Personal Tax Cut For 25 Years Bbc News

Who Goes To Prison For Tax Evasion H R Block

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Easy Guide To Crypto Taxes For 2022 Gordon Law Group

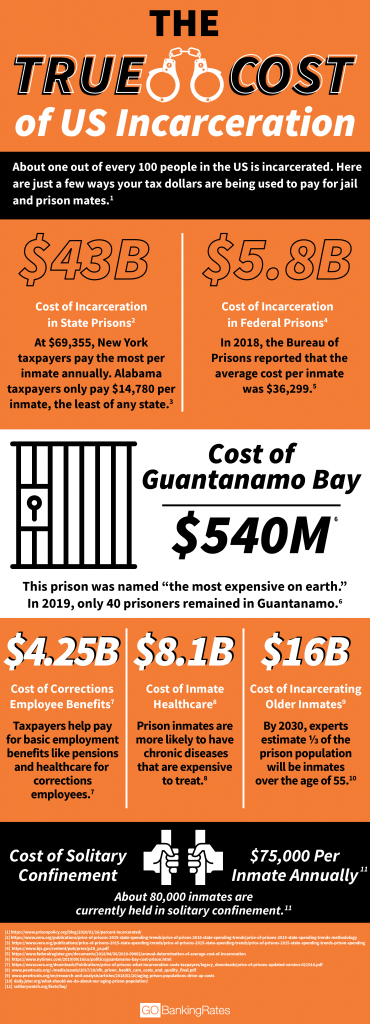

How Much Do Taxpayers Pay For Prisoners Gobankingrates

How To Avoid Paying Taxes Legally

Picture Memes Pmz2bpld6 Ifunny

Wesley Snipes Who Was Jailed For Failure To File Taxes Claims Trump Avoided Tax Because Of Who He Knows The Independent

:max_bytes(150000):strip_icc()/GettyImages-641141038-635672bd575846b5bfcb889f7665134e.jpg)